Formal Problem Statement CS_Optimization_Utilities

Notations

I = number of instruments in portfolio; i = {1,…,I} index of instruments in portfolio;

J = number of scenarios; j = {1,…,J} index of scenarios;

![]() = portion of wealth invested in instrument i, i = {1,…,I};

= portion of wealth invested in instrument i, i = {1,…,I};

![]() = vector of decision variables;

= vector of decision variables;

![]() = lower bound on portion of wealth invested in instrument i, i = {1,…,I};

= lower bound on portion of wealth invested in instrument i, i = {1,…,I};

![]() = upper bound on wealth invested in instrument i, i = {1,…,I};

= upper bound on wealth invested in instrument i, i = {1,…,I};

![]() = price of instrument i at initial time 0;

= price of instrument i at initial time 0;

![]() = price-vector at initial time 0;

= price-vector at initial time 0;

![]() = price of instrument i for scenario j at time 1;

= price of instrument i for scenario j at time 1;

![]() = rate of return of instrument i for scenario j;

= rate of return of instrument i for scenario j;

![]() = return of instrument i for scenario j;

= return of instrument i for scenario j;

![]() = random value having J equally probable scenarios of rates of return,

= random value having J equally probable scenarios of rates of return, ![]() ;

;

![]() = random value having J equally probable scenarios of returns,

= random value having J equally probable scenarios of returns, ![]()

![]() = random vector of rates of return;

= random vector of rates of return;

![]() = random return vector;

= random return vector;

![]() = vector of rates of return for scenario j;

= vector of rates of return for scenario j;

![]() = return vector for scenario j;

= return vector for scenario j;

|

= rate of return of the portfolio for scenario j; |

|

= return of the portfolio for scenario j; |

|

= Average Gain function; |

|

=Partial Moment Two Penalty |

function, where w is a threshold value;

|

= Exponential utility function, where a>0; |

|

= Logarithmic utility function; |

|

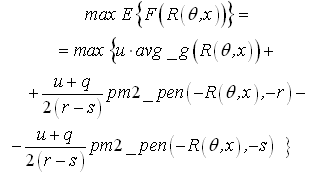

=Linear-Quadratic utility function, where |

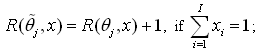

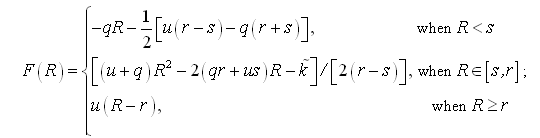

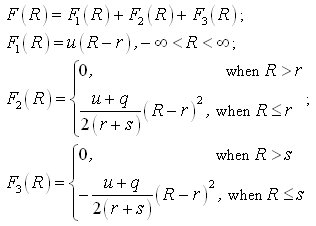

F(R) = an appraisal (= monitoring) function, a linear-quadratic function modeling the decision maker attitude towards risk.

F(R) is defined as follows:

r = the hurdle rate;

s = the sub-hurdle rate, s < r;

u, q =constants, q < - u < 0;

![]()

The function F(R) can be represented as follows:

Optimization Problem 1

Maximizing Exponential Utility

|

(CS.1) |

subject to

budget constraint

|

(CS.2) |

bounds on positions

|

(CS.3) |

Optimization Problem 2

Maximizing Linear-Quadratic Utility

|

(CS.4) |

subject to

budget constraint

|

(CS.5) |

bounds on positions

|

(CS.6) |

Optimization Problem 3

Maximizing Logarithmic Utility

|

(CS.7) |

subject to

budget constraint

|

(CS.8) |

bounds on positions

|

(CS.9) |

Initial Data

Number of instruments in the portfolio, I = 12;

Number of scenarios, J = 199554;

Values of parameters:

q = -20;

u = 1;

r = 10;

s = 3.