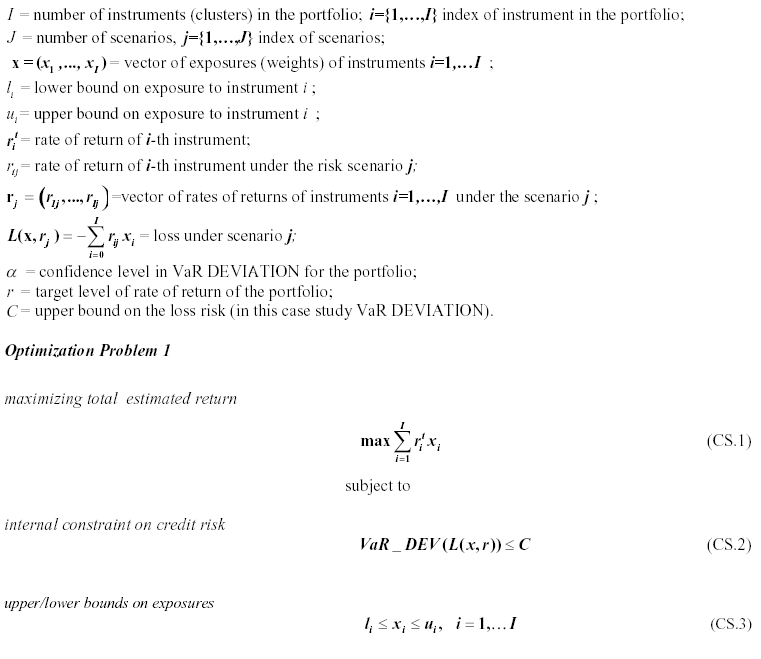

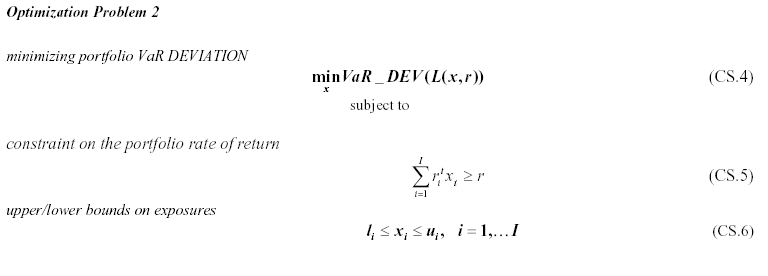

Formal Problem Statement

Notations

Initial Data

Number of clusters in the Retail Portfolio, I = 23.

Number of scenarios (time periods), J = 10,000.

The confidence level in VaR DEVIATION for the portfolio, a = 99.84%

The raw data for the small version includes the following files:

| • | data_needed_retail.txt |

| • | OSD_BM_1.out, and OSD_BM_2.out |

| • | Scenario_lr_R_small.txt (this file includes first 10,000 scenarios from the file Scenario_lr_R..txt |

File data_needed_retail.txt contains the following information:

| • | List of instruments |

| • | Composition of clusters |

| • | Current value for each instrument |

| • | Rate of return for each instrument |

Files OSD_BM_1.out, and OSD_BM_2.out contain price scenarios for each instrument.

File Scenario_lr_R_small.txt contains the current portfolio value scenarios (which are not used in this case study) and corresponding Likelihood Ratios.

Two cases are considered:

Case 1: Lower bound for i-th cluster is 90% and upper bound is 110% of its current weight;

Case 2: Lower bound for i-th cluster is 80% and upper bound is 120% of its current weight.